B. Riley Securities Initiates Coverage of Federal National Mortgage Association - Preferred Stock (FNMAT) with Neutral Recommendation

Fintel reports that on September 5, 2025, B. Riley Securities initiated coverage of Federal National Mortgage Association - Preferred Stock (OTCPK:FNMAT) with a Neutral recommendation.

Analyst Price Forecast Suggests 20.00% Downside

As of August 22, 2025, the average one-year price target for Federal National Mortgage Association - Preferred Stock is $3.69/share. The forecasts range from a low of $1.46 to a high of $6.07. The average price target represents a decrease of 20.00% from its latest reported closing price of $4.61 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Federal National Mortgage Association - Preferred Stock is 28,233MM, a decrease of 2.29%. The projected annual non-GAAP EPS is 0.00.

What is the Fund Sentiment?

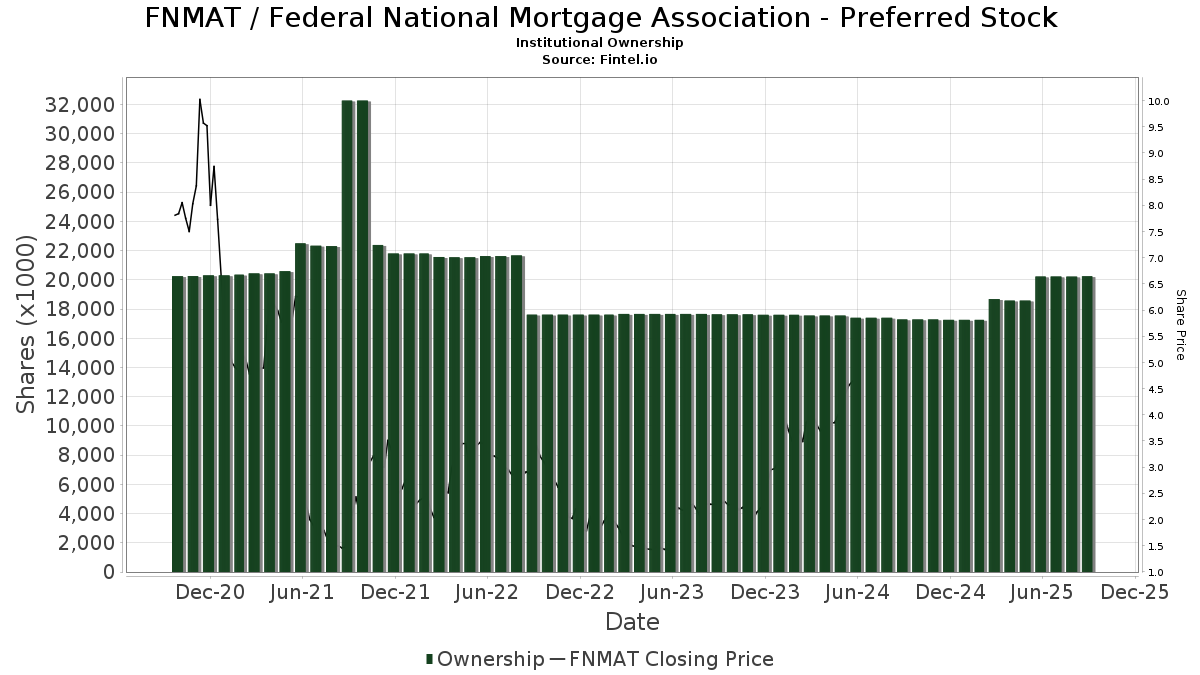

There are 7 funds or institutions reporting positions in Federal National Mortgage Association - Preferred Stock. This is an increase of 1 owner(s) or 16.67% in the last quarter. Average portfolio weight of all funds dedicated to FNMAT is 0.34%, an increase of 3.93%. Total shares owned by institutions increased in the last three months by 0.10% to 20,247K shares.

What are Other Shareholders Doing?

AIVSX - INVESTMENT CO OF AMERICA holds 11,530K shares. No change in the last quarter.

AGTHX - GROWTH FUND OF AMERICA holds 6,949K shares. In its prior filing, the firm reported owning 6,954K shares , representing a decrease of 0.08%. The firm increased its portfolio allocation in FNMAT by 22.64% over the last quarter.

BlackRock Funds V - BlackRock Strategic Income Opportunities Portfolio Investor A Shares holds 1,500K shares. In its prior filing, the firm reported owning 1,465K shares , representing an increase of 2.33%. The firm increased its portfolio allocation in FNMAT by 23.85% over the last quarter.

GOODX - GoodHaven Fund holds 217K shares. No change in the last quarter.

APPLX - Appleseed Fund Investor Class holds 30K shares. In its prior filing, the firm reported owning 40K shares , representing a decrease of 33.33%. The firm decreased its portfolio allocation in FNMAT by 3.91% over the last quarter.