Goldman Sachs Upgrades BorgWarner (BWA)

Fintel reports that on April 10, 2025, Goldman Sachs upgraded their outlook for BorgWarner (NYSE:BWA) from Neutral to Buy.

Analyst Price Forecast Suggests 39.87% Upside

As of April 2, 2025, the average one-year price target for BorgWarner is $37.61/share. The forecasts range from a low of $31.31 to a high of $44.10. The average price target represents an increase of 39.87% from its latest reported closing price of $26.89 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for BorgWarner is 18,773MM, an increase of 33.27%. The projected annual non-GAAP EPS is 6.51.

What is the Fund Sentiment?

There are 1,308 funds or institutions reporting positions in BorgWarner.

This is an increase of 42 owner(s) or 3.32% in the last quarter.

Average portfolio weight of all funds dedicated to BWA is 0.19%, an increase of 7.13%.

Total shares owned by institutions increased in the last three months by 6.24% to 275,206K shares.

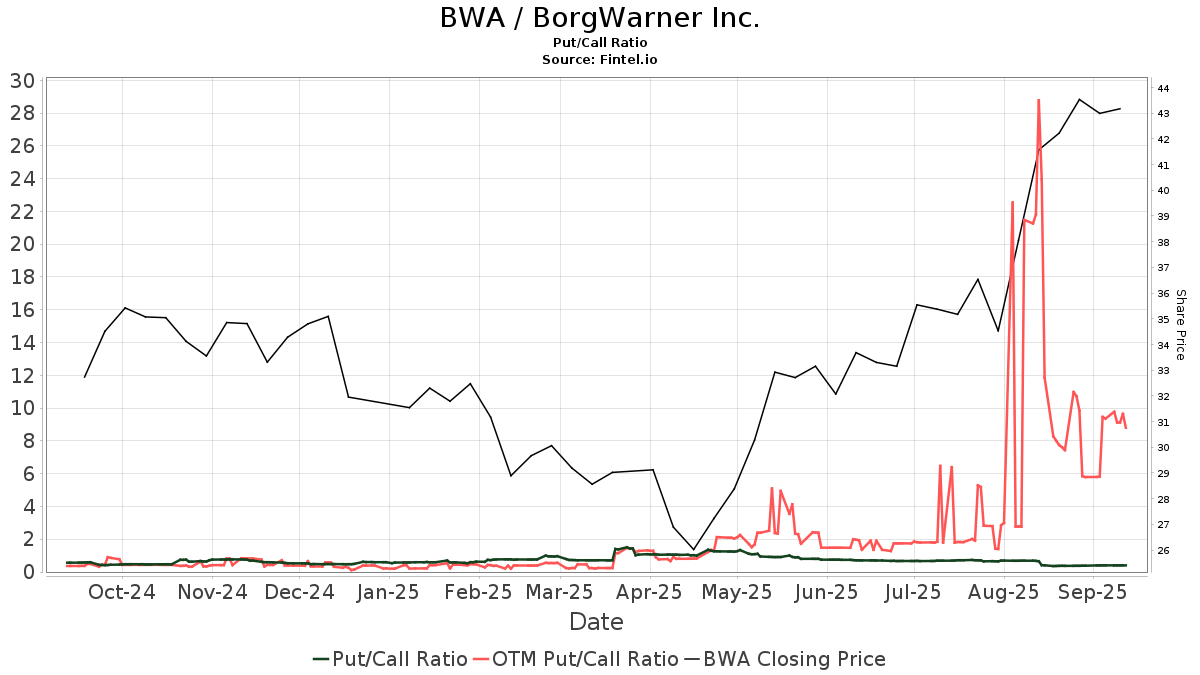

The put/call ratio of BWA is 1.06, indicating a

bearish outlook.

The put/call ratio of BWA is 1.06, indicating a

bearish outlook.

What are Other Shareholders Doing?

Victory Capital Management holds 12,193K shares representing 5.55% ownership of the company. In its prior filing, the firm reported owning 12,258K shares , representing a decrease of 0.53%. The firm decreased its portfolio allocation in BWA by 42.13% over the last quarter.

Harris Associates L P holds 11,738K shares representing 5.34% ownership of the company. In its prior filing, the firm reported owning 11,839K shares , representing a decrease of 0.87%. The firm decreased its portfolio allocation in BWA by 31.76% over the last quarter.

VETAX - Victory Sycamore Established Value Fund holds 8,860K shares representing 4.03% ownership of the company. In its prior filing, the firm reported owning 9,010K shares , representing a decrease of 1.69%. The firm decreased its portfolio allocation in BWA by 8.52% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 6,861K shares representing 3.12% ownership of the company. In its prior filing, the firm reported owning 7,235K shares , representing a decrease of 5.46%. The firm decreased its portfolio allocation in BWA by 18.14% over the last quarter.

Invesco holds 6,795K shares representing 3.09% ownership of the company. In its prior filing, the firm reported owning 6,166K shares , representing an increase of 9.26%. The firm decreased its portfolio allocation in BWA by 91.65% over the last quarter.

BorgWarner Background Information

(This description is provided by the company.)

BorgWarner Inc. is a global product leader in clean and efficient technology solutions for combustion, hybrid and electric vehicles. Building on its original equipment expertise, BorgWarner also brings market leading product and service solutions to the global aftermarket. With manufacturing and technical facilities in 96 locations in 24 countries, the Company employs approximately 50,000 worldwide.