Morgan Stanley Downgrades Freeport-McMoRan (FCX)

Fintel reports that on July 15, 2025, Morgan Stanley downgraded their outlook for Freeport-McMoRan (NYSE:FCX) from Overweight to Equal-Weight.

Analyst Price Forecast Suggests 4.11% Upside

As of June 20, 2025, the average one-year price target for Freeport-McMoRan is $47.51/share. The forecasts range from a low of $27.59 to a high of $63.04. The average price target represents an increase of 4.11% from its latest reported closing price of $45.63 / share.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Freeport-McMoRan is 25,035MM, an increase of 0.70%. The projected annual non-GAAP EPS is 2.38.

What is the Fund Sentiment?

There are 2,414 funds or institutions reporting positions in Freeport-McMoRan.

This is unchanged over the last quarter.

Average portfolio weight of all funds dedicated to FCX is 0.38%, an increase of 13.33%.

Total shares owned by institutions increased in the last three months by 0.93% to 1,446,711K shares.

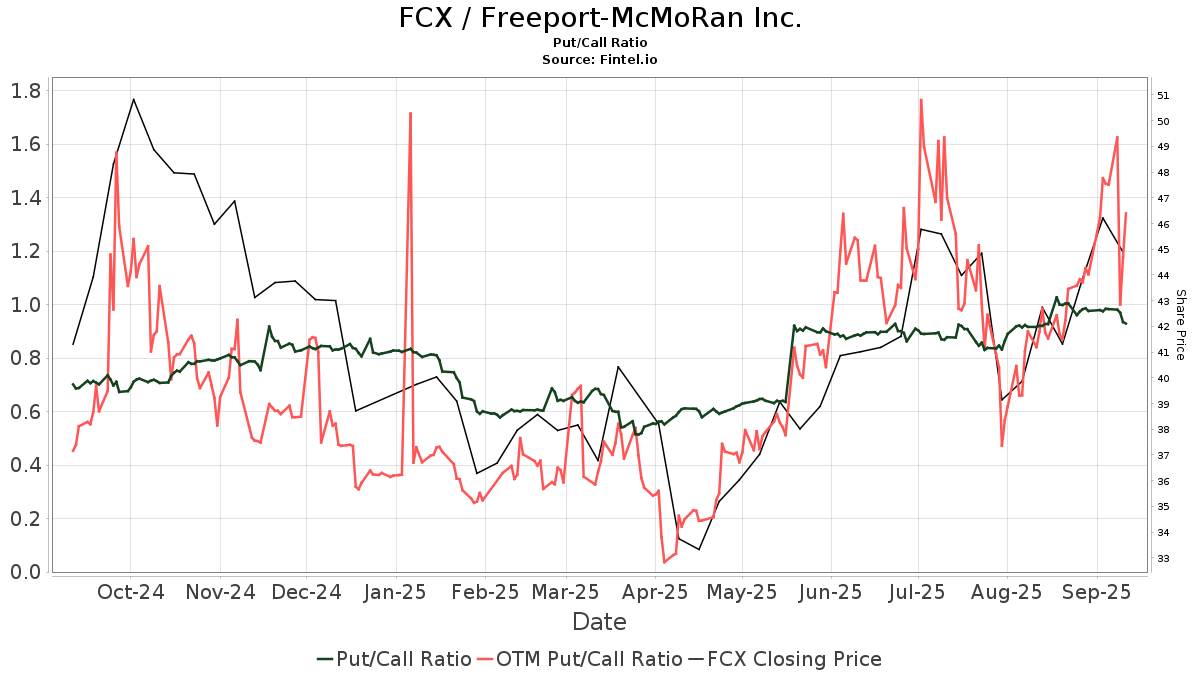

The put/call ratio of FCX is 0.92, indicating a

bullish outlook.

The put/call ratio of FCX is 0.92, indicating a

bullish outlook.

What are Other Shareholders Doing?

Fisher Asset Management holds 60,432K shares representing 4.21% ownership of the company. In its prior filing, the firm reported owning 59,365K shares , representing an increase of 1.77%. The firm increased its portfolio allocation in FCX by 10.12% over the last quarter.

Capital Research Global Investors holds 59,153K shares representing 4.12% ownership of the company. In its prior filing, the firm reported owning 77,313K shares , representing a decrease of 30.70%. The firm decreased its portfolio allocation in FCX by 19.55% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 45,391K shares representing 3.16% ownership of the company. In its prior filing, the firm reported owning 45,039K shares , representing an increase of 0.78%. The firm increased its portfolio allocation in FCX by 4.53% over the last quarter.

VFINX - Vanguard 500 Index Fund Investor Shares holds 39,930K shares representing 2.78% ownership of the company. In its prior filing, the firm reported owning 38,896K shares , representing an increase of 2.59%. The firm increased its portfolio allocation in FCX by 4.22% over the last quarter.

Price T Rowe Associates holds 37,547K shares representing 2.61% ownership of the company. In its prior filing, the firm reported owning 31,886K shares , representing an increase of 15.08%. The firm increased its portfolio allocation in FCX by 25.13% over the last quarter.

Freeport-McMoRan Background Information

(This description is provided by the company.)

FCX is a leading international mining company with headquarters in Phoenix, Arizona. FCX operates large, long-lived, geographically diverse assets with significant proven and probable reserves of copper, gold and molybdenum. FCX is one of the world's largest publicly traded copper producers. FCX's portfolio of assets includes the Grasberg minerals district in Indonesia, one of the world's largest copper and gold deposits; and significant mining operations in North America and South America, including the large-scale Morenci minerals district in Arizona and the Cerro Verde operation in Peru. By supplying responsibly produced copper, FCX is proud to be a positive contributor to the world well beyond its operational boundaries. Additional information about FCX is available on FCX's website at 'fcx.com.'