Paek Nack Y Increases Position in Metrocity Bankshares (MCBS)

Fintel reports that Paek Nack Y has filed a 13G form with the SEC disclosing ownership of 1.34MM shares of Metrocity Bankshares Inc (MCBS). This represents 5.31% of the company.

In their previous filing dated February 2, 2022 they reported 1.29MM shares and 5.06% of the company, an increase in shares of 3.83% and an increase in total ownership of 0.25% (calculated as current - previous percent ownership).

Analyst Price Forecast Suggests 13.00% Upside

As of February 2, 2023, the average one-year price target for Metrocity Bankshares is $22.95. The forecasts range from a low of $22.22 to a high of $24.15. The average price target represents an increase of 13.00% from its latest reported closing price of $20.31.

The projected annual revenue for Metrocity Bankshares is $136MM, a decrease of 4.25%. The projected annual EPS is $2.27, a decrease of 12.00%.

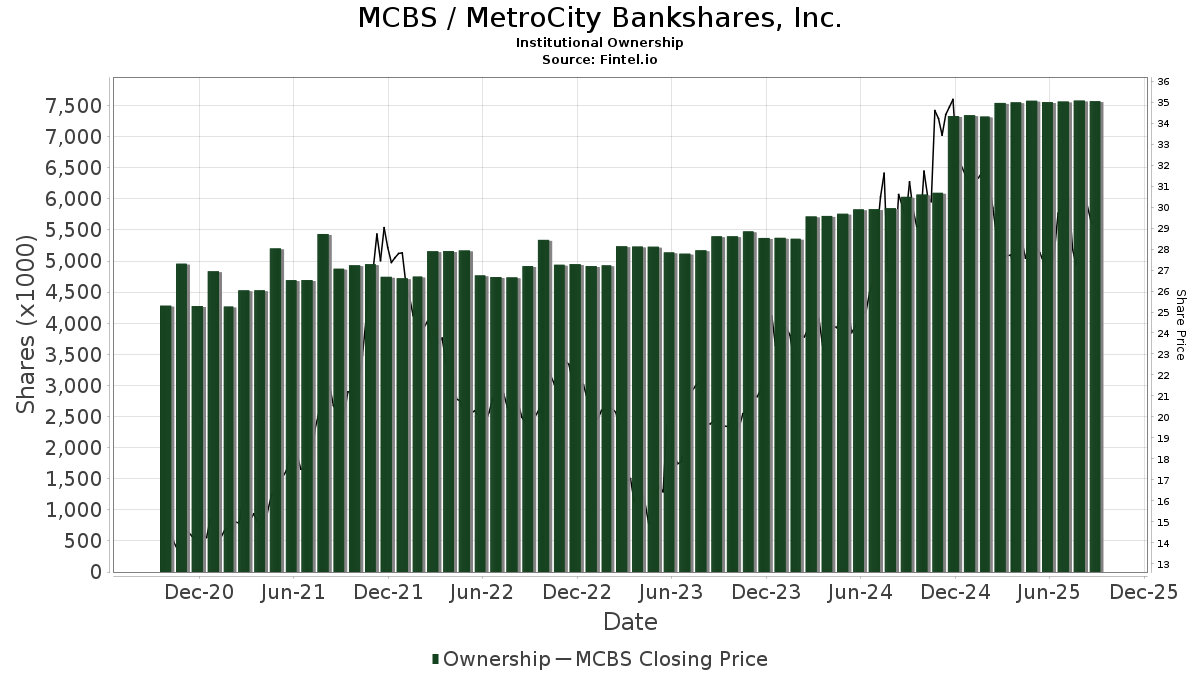

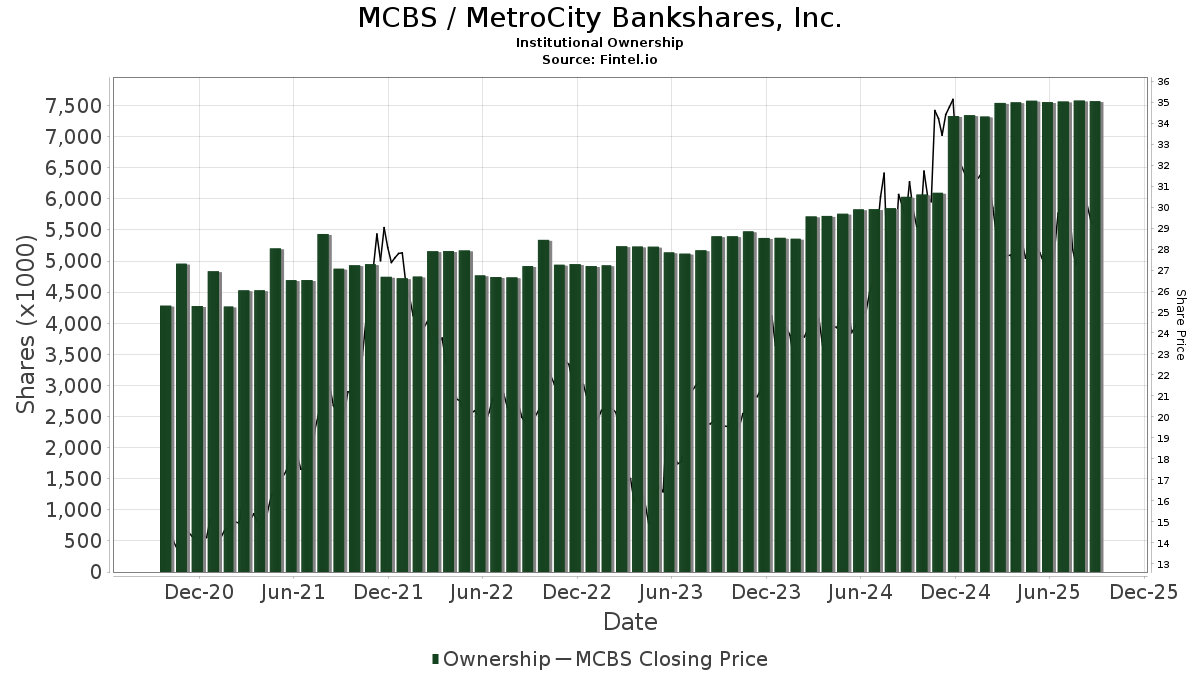

Fund Sentiment

There are 186 funds or institutions reporting positions in Metrocity Bankshares. This is a decrease of 0 owner(s) or 0.00%.

Average portfolio weight of all funds dedicated to US:MCBS is 0.0260%, an increase of 15.5998%. Total shares owned by institutions decreased in the last three months by 0.18% to 4,931K shares.

What are large shareholders doing?

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 554,638 shares representing 2.20% ownership of the company. No change in the last quarter.

IWM - iShares Russell 2000 ETF holds 427,618 shares representing 1.70% ownership of the company. In it's prior filing, the firm reported owning 450,632 shares, representing a decrease of 5.38%. The firm decreased its portfolio allocation in MCBS by 0.62% over the last quarter.

Geode Capital Management holds 323,294 shares representing 1.28% ownership of the company. In it's prior filing, the firm reported owning 318,065 shares, representing an increase of 1.62%. The firm increased its portfolio allocation in MCBS by 1.78% over the last quarter.

Manufacturers Life Insurance Company, The holds 264,136 shares representing 1.05% ownership of the company. In it's prior filing, the firm reported owning 271,926 shares, representing a decrease of 2.95%. The firm decreased its portfolio allocation in MCBS by 5.75% over the last quarter.

VEXMX - Vanguard Extended Market Index Fund Investor Shares holds 260,969 shares representing 1.04% ownership of the company. In it's prior filing, the firm reported owning 237,854 shares, representing an increase of 8.86%. The firm increased its portfolio allocation in MCBS by 7.91% over the last quarter.

Metrocity Bankshares Declares $0.18 Dividend

Metrocity Bankshares said on January 18, 2023 that its board of directors declared a regular quarterly dividend of $0.18 per share ($0.72 annualized). Shareholders of record as of January 31, 2023 will receive the payment on February 10, 2023. Previously, the company paid $0.15 per share.

At the current share price of $20.31 / share, the stock's dividend yield is 3.55%. Looking back five years and taking a sample every week, the average dividend yield has been 2.76%, the lowest has been 1.60%, and the highest has been 4.75%. The standard deviation of yields is 0.61 (n=156).

The current dividend yield is 1.29 standard deviations above the historical average.

Additionally, the company's dividend payout ratio is 0.28. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation. Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.64%, demonstrating that it has increased its dividend over time.

MetroCity Bankshares Background Information

(This description is provided by the company.)

MetroCity Bankshares, Inc. is a Georgia corporation and a registered bank holding company for its wholly-owned banking subsidiary, Metro City Bank, which is headquartered in the Atlanta, Georgia metropolitan area. Founded in 2006, Metro City Bank currently operates 19 full-service branch locations in multi-ethnic communities in Alabama, Florida, Georgia, New York, New Jersey, Texas and Virginia.