Pilbara Minerals (ASX:PLS) Price Target Decreased by 5.60% to 4.62

The average one-year price target for Pilbara Minerals (ASX:PLS) has been revised to 4.62 / share. This is an decrease of 5.60% from the prior estimate of 4.89 dated April 6, 2023.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 3.04 to a high of 8.08 / share. The average price target represents an increase of 14.81% from the latest reported closing price of 4.02 / share.

See our leaderboard of companies with the largest price target upside.

What is the Fund Sentiment?

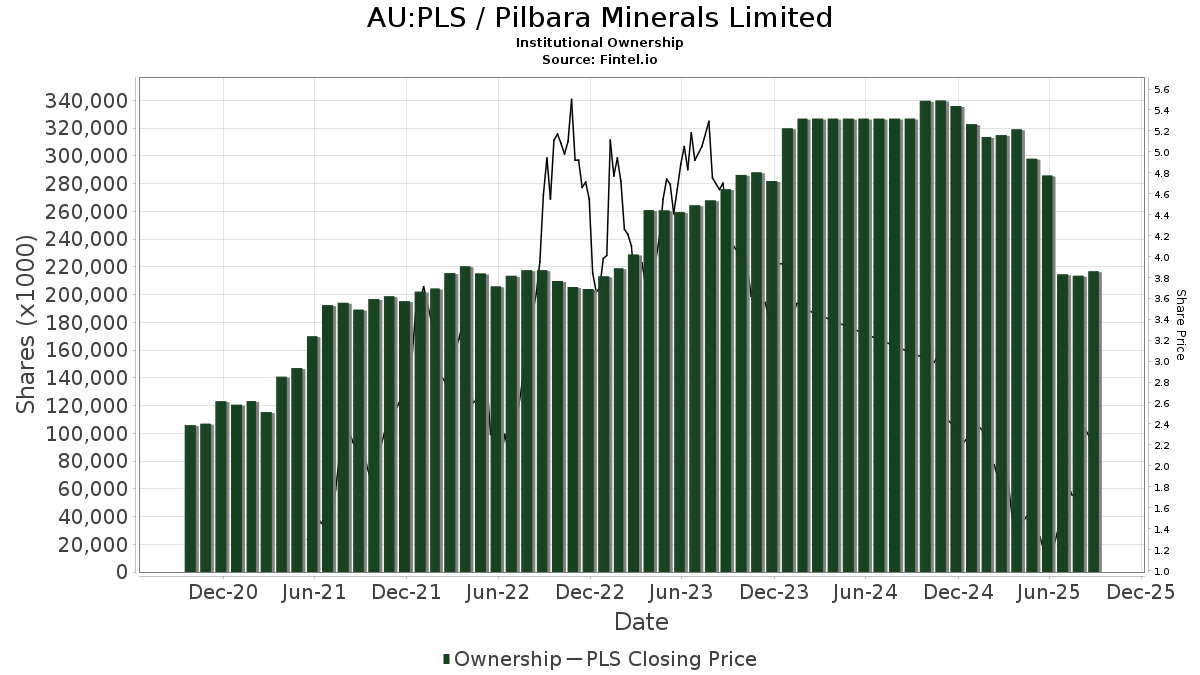

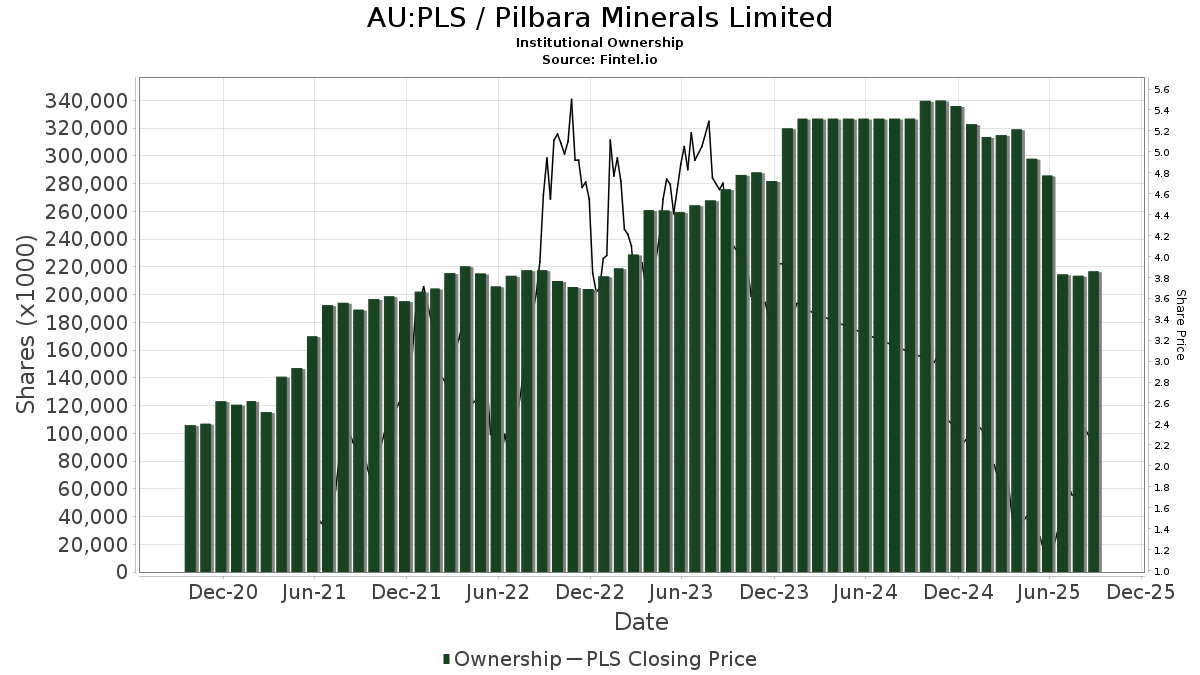

There are 211 funds or institutions reporting positions in Pilbara Minerals. This is an increase of 113 owner(s) or 115.31% in the last quarter. Average portfolio weight of all funds dedicated to PLS is 0.25%, a decrease of 41.64%. Total shares owned by institutions increased in the last three months by 13.27% to 241,719K shares.

What are Other Shareholders Doing?

LIT - Global X Lithium & Battery Tech ETF holds 34,893K shares representing 1.16% ownership of the company. In it's prior filing, the firm reported owning 40,596K shares, representing a decrease of 16.34%. The firm decreased its portfolio allocation in PLS by 8.47% over the last quarter.

VGTSX - Vanguard Total International Stock Index Fund Investor Shares holds 34,791K shares representing 1.16% ownership of the company. In it's prior filing, the firm reported owning 35,192K shares, representing a decrease of 1.15%. The firm decreased its portfolio allocation in PLS by 11.84% over the last quarter.

VTMGX - Vanguard Developed Markets Index Fund Admiral Shares holds 20,098K shares representing 0.67% ownership of the company. In it's prior filing, the firm reported owning 19,614K shares, representing an increase of 2.41%. The firm decreased its portfolio allocation in PLS by 24.09% over the last quarter.

REMX - VanEck Vectors Rare Earth holds 18,189K shares representing 0.61% ownership of the company. In it's prior filing, the firm reported owning 20,271K shares, representing a decrease of 11.45%. The firm decreased its portfolio allocation in PLS by 13.72% over the last quarter.

IEFA - iShares Core MSCI EAFE ETF holds 13,534K shares representing 0.45% ownership of the company. In it's prior filing, the firm reported owning 12,711K shares, representing an increase of 6.08%. The firm decreased its portfolio allocation in PLS by 7.79% over the last quarter.