Основная статистика

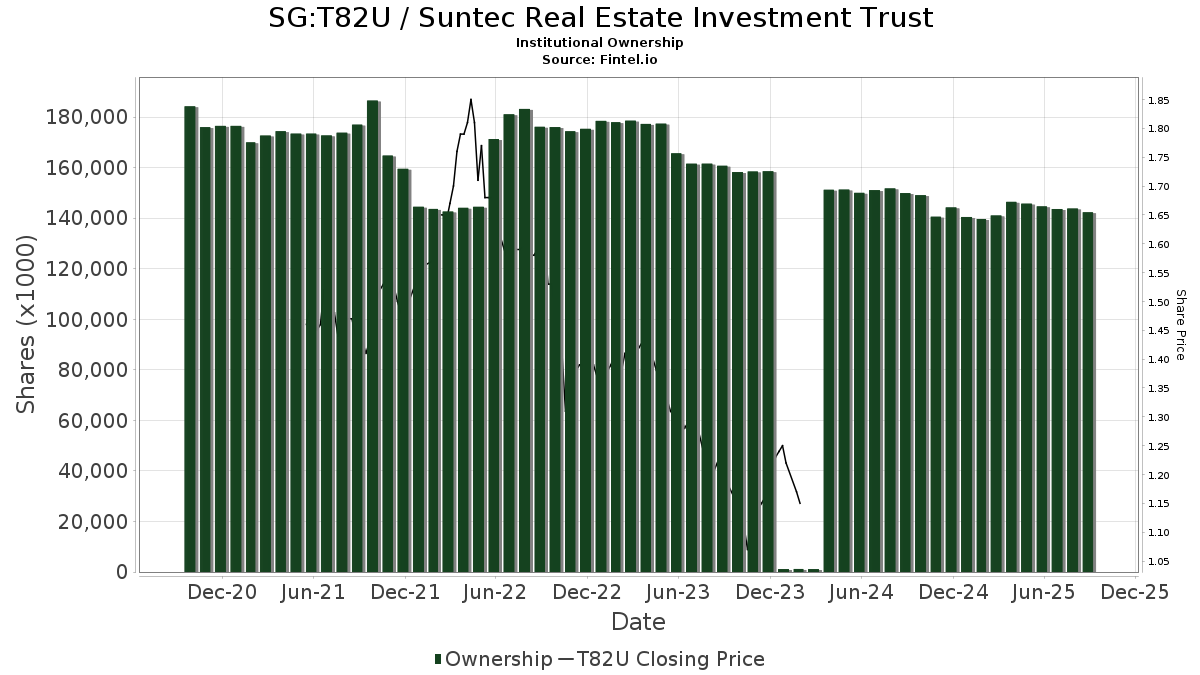

| Институциональные акции (длинные) | 142 323 106 - 4,84% (ex 13D/G) - change of -2,33MM shares -1,61% MRQ |

| Институциональная стоимость (длинная позиция) | $ 125 633 USD ($1000) |

Институциональная собственность и акционеры

Suntec Real Estate Investment Trust (SG:T82U) имеет 47 институциональные владельцы и акционеры, подавшие формы 13D/G или 13F в Комиссию по ценным бумагам и биржам (SEC). Эти учреждения владеют в общей сложности 142,323,106 акциями. В число крупнейших акционеров входят VGTSX - Vanguard Total International Stock Index Fund Investor Shares, VTMGX - Vanguard Developed Markets Index Fund Admiral Shares, DFA INVESTMENT DIMENSIONS GROUP INC - DFA International Real Estate Securities Portfolio - Institutional Class, IEFA - iShares Core MSCI EAFE ETF, VGRLX - Vanguard Global ex-U.S. Real Estate Index Fund Admiral, SCZ - iShares MSCI EAFE Small-Cap ETF, GICIX - Goldman Sachs International Small Cap Insights Fund Institutional, REET - iShares Global REIT ETF, VEU - Vanguard FTSE All-World ex-US Index Fund ETF Shares, and SCHF - Schwab International Equity ETF .

Институциональная структура собственности Suntec Real Estate Investment Trust (SGX:T82U) показывает текущие позиции в компании по учреждениям и фондам, а также последние изменения в размере позиций. Крупнейшими акционерами могут быть индивидуальные инвесторы, взаимные фонды, хедж-фонды или учреждения. Приложение 13D указывает, что инвестор владеет (или держал) более 5% компании и намерен (или намеревался) активно проводить изменение бизнес-стратегии. График 13G указывает на пассивные инвестиции более 5%.

Оценка настроений фонда

Оценка настроений фондов (fka Ownership Accumulation Score) определяет акции, которые фонды покупают больше всего. Это результат сложной многофакторной количественной модели, которая идентифицирует компании с самым высоким уровнем институционального накопления. В скоринговой модели используется комбинация общего увеличения раскрытых владельцев, изменений в распределении портфелей этих владельцев и других показателей. Число варьируется от 0 до 100, причем более высокие цифры указывают на более высокий уровень накопления по сравнению с аналогами, а 50 — это среднее значение.

Частота обновлений: ежедневно

См. Ownership Explorer, в котором представлен список компаний с самым высоким рейтингом.

Документы 13F и NPORT

Подробная информация о документах 13F предоставляется бесплатно. Подробная информация о подаче заявок NP требует премиум-членства. Зеленые строки обозначают новые позиции. Красные строки обозначают закрытые позиции. Нажмите на ссылку значок, чтобы просмотреть полную историю транзакций.

Обновление

чтобы разблокировать премиум-данные и экспортировать их в Excel ![]() .

.